Crypto Tax Reconciliation: What Makes It Different?

Why is crypto tax reconciliation more complex and challenging compared to TradFi? Explore the differences, associated challenges, and strategies to simplify your accounting workflow.

Reconciliation is a critical process for every organization. This comes with a valid reason, as it ensures their corporate tax return is filed accurately – so both tax officials and internal stakeholders are satisfied.

Though, as expected, tax reconciliation is applied differently in crypto. Compared to traditional finance, Web3 organizations rely on multiple complex data sources versus only a few.

With regulatory complexities and high volume of digital asset transactions, this can cause discrepancies in any crypto organization's tax returns.

To manage this, we’ll explore crypto tax reconciliation further through understanding:

What is tax reconciliation and how it differs in crypto

Why organizations reconcile crypto transactions for tax purposes

Its internal process of reconciling tax transactions

How to reconcile taxable income as a Web3 organization

When you should consider reconciliation support for your crypto taxes

What is Reconciliation in TradFi?

Accountants already understand what tax reconciliation is and how it applies in the TradFi world. However, as this becomes more complicated in crypto, it's essential to review its principles.

In finance, reconciliation refers to the process of ensuring that one account's balance matches another. Here, we differentiate multiple types, with the two most common categories including:

Bank reconciliation: You compare your organization's accounts to your financial institution's monthly statements to discover missing transactions or other issues and then resolve them.

Vendor reconciliation: You reconcile your organization's accounts with its vendors' statements to check whether the sum you paid for a vendor's service matches the amount they received. This prevents potential conflicts between your organization and its partners.

Besides the above, other reconciliation types include:

Business-specific reconciliation: Ensure internal records' accuracy at the start and the end of your organization's financial cycle.

Intercompany reconciliation: Spot and correct accounting errors by unifying the accounts of a parent company and its subsidiaries.

Customer reconciliation: Reveal anomalies, errors, or mistakes in the accounting of an organization's clients.

What Is Tax Reconciliation and How Does it Differ in Crypto?

Tax reconciliation (also called book-to-tax reconciliation) is when you reconcile your organization's net income on the books to the income reported on the annual tax return.

In traditional finance, reconciling tax is not overly complex with access to your organization's bank account. By generating a monthly report, you now have a single source to ensure that the claims you make on your return are valid.

In the cryptocurrency industry, however, the reconciliation process is more difficult than in TradFi. The reason is simple: financial institutions are not integrated into blockchain networks’ infrastructure. This means you can't reconcile crypto transactions for tax purposes against monthly institutional statements.

Instead, you have to rely on a variety of other resources, including:

Block explorers: Block explorers are the services that provide insight into all the records, transactions, balances, and other publicly-recorded data in blockchain networks.

Exchanges: Apart from deposits and withdrawals, centralized exchanges (CEXs) like Binance, Coinbase, and Kraken execute mostly off-chain transactions on their platforms. As these records are stored outside blockchain networks, you have to use CEXs as separate sources for crypto tax reconciliation.

Centralized Finance (CeFi) providers: From centralized lending services and launchpads to custodial staking platforms, CeFi solutions settle off-chain transactions in their ecosystems. Like CEXs, this makes their records inaccessible via block explorers.

The problem comes when one or more sources become unreliable.

For example, your organization uses a CEX to trade USDC for BTC but later shuts down its services. However, no service can guarantee 100% uptime, especially after bankruptcy or a security hack.

So when a centralized service shuts down, organizations are unable to access their account data. Unless regular screenshots of your activity were taken, a defunct crypto platform can make tax reconciliation a nightmare for your finance team.

On the other hand, block explorers are considered more reliable in crypto as they pull data directly from blockchain networks. And it's a correct assumption in the case of an established blockchain like Ethereum, where everything is available reliably on Etherscan. But this can change when trying to access records on newer or less popular chains that haven't yet established a robust infrastructure for block explorers.

Integral ensures data accuracy by reading data directly from blockchains using a combination of RPC APIs from leading node providers

Why is Tax Reconciliation Important for Web3 Organizations?

Reconciliation is crucial for getting a clear picture of your finances.

It allows you to forecast accurately and assess the financial health of your Web3 organization or DAO; encouraging action when necessary.

When it comes to taxes, crypto reconciliation ensures that the records on your books match the ones on third-party sources like block explorers. This way, you can confirm that your organization's tax returns include only accurate data.

Failure to achieve this could result in costly penalties. For example, the fine can be as much as 100% of the extra tax due in the UK, depending on the reasons for the errors. Deliberate and concealed cases involve the largest penalties.

At the same time, an accuracy-related penalty is 20% in the US, with the IRS charging interest on fines imposed on tax reporting errors.

Let’s assume you’re a web3 accountant of an NFT project that launched its collection on OpenSea last year.

According to your internal books maintained in spreadsheets. The organization generated $100,000 in primary sales and $5,000 in secondary sales through NFT royalties. Throughout the year, you bought 2 BTC for $60,000 in total, from which you sold 1 BTC for $30,000.

To reconcile your crypto transactions for tax purposes, you need to source and calculate the following:

Inbound/outbound txns of all your wallets and CeFi or CEX accounts

Realized gains/losses

Unrealized gains/losses

We will use this newly-sourced data to create an income statement for your NFT project.

Note: The figures cited below are for educational purposes only.

1. Reconcile Against Your Treasury

Suppose all your crypto activity concentrates on one non-custodial wallet and an exchange account. The former is your NFT treasury, and you utilize the latter for trades between crypto and fiat currencies.

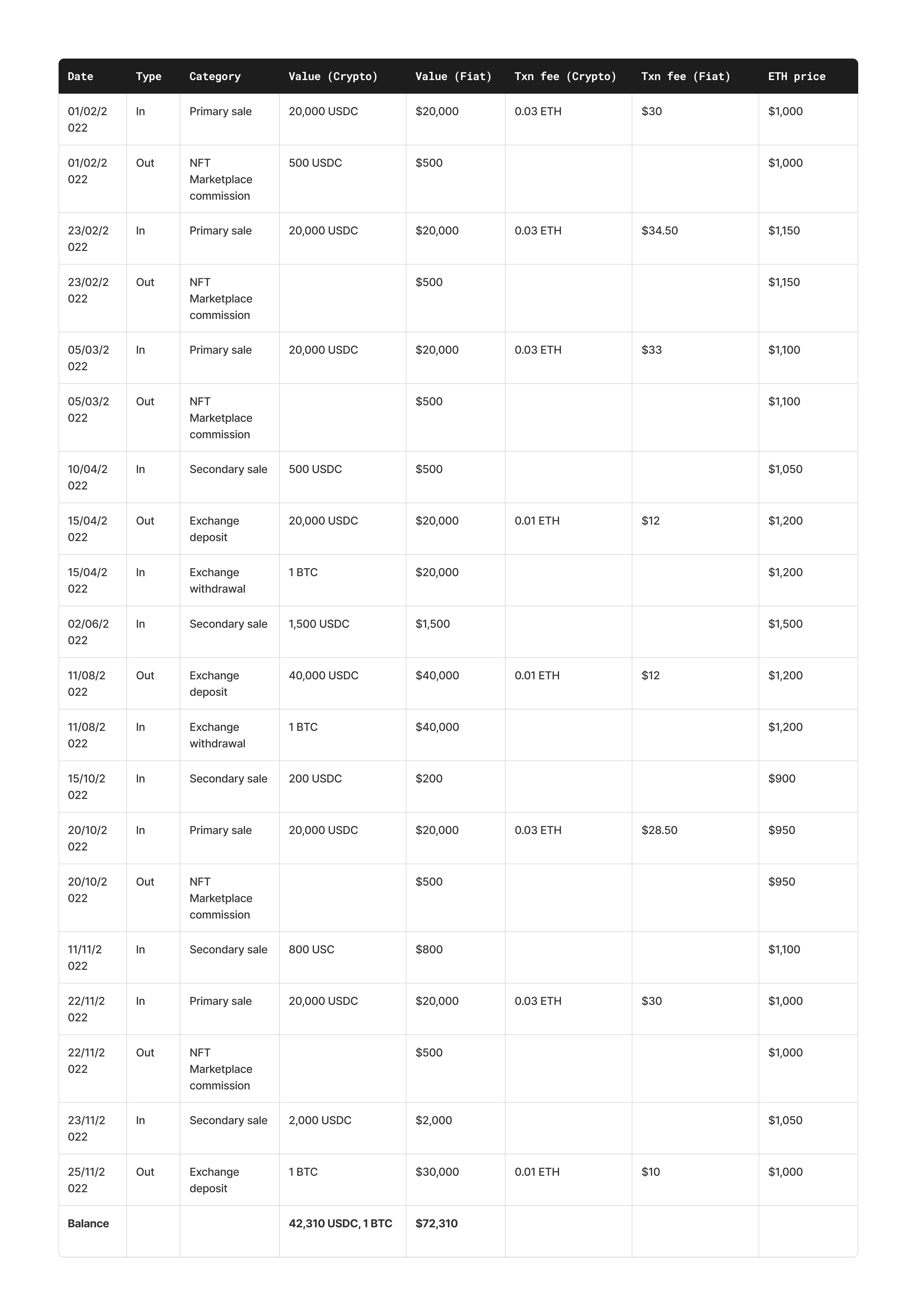

Based on public blockchain data accessible via Etherscan, your NFT treasury's ins and outs look like this:

To simplify, ETH gas fees are subtracted from your organization's USDC balance in the above table.

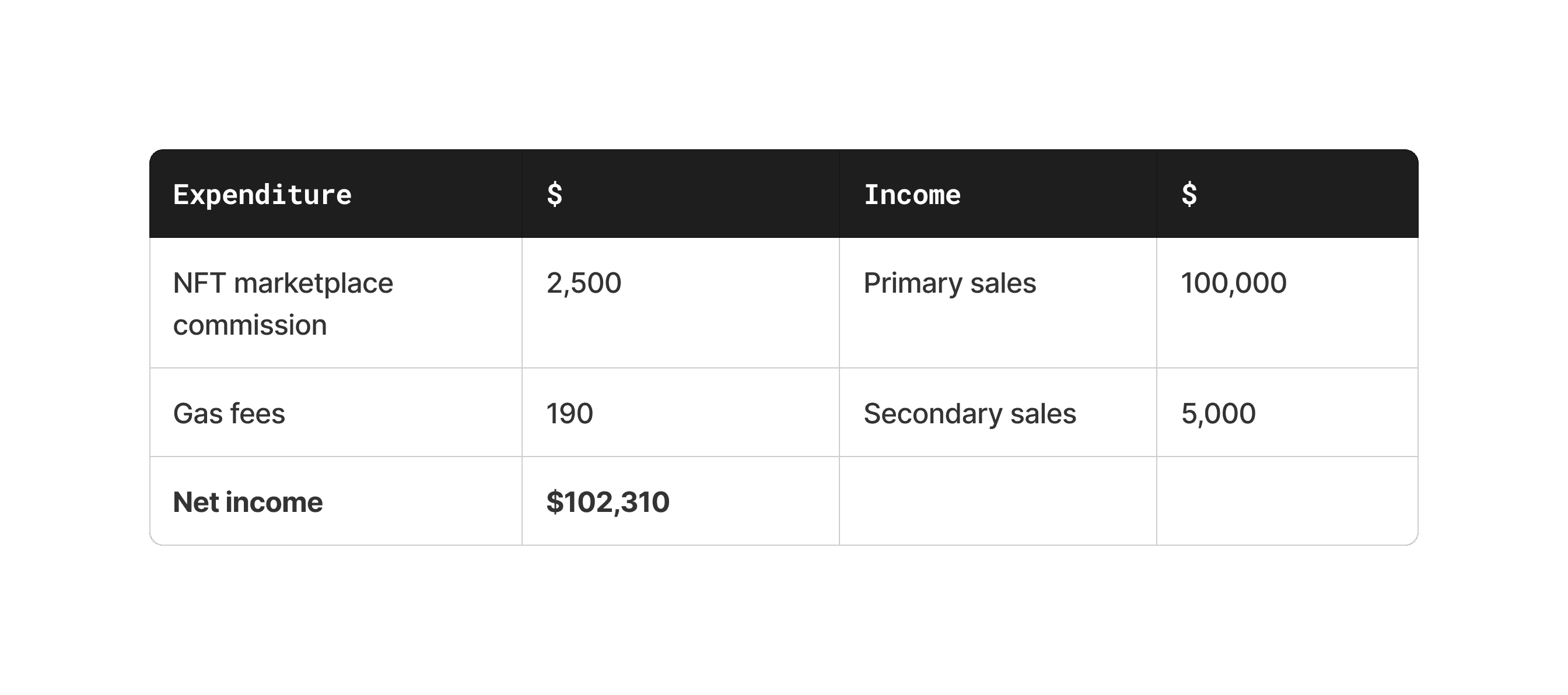

We can use the above NFT treasury data to now create your organization's income statement:

As you can see, our example is very simple and only includes the P&L of the data we could gather on-chain.

It is important to note that individuals cannot use gas fees to offset personal income. However, businesses can deduct any expenses related to operating their business. Given this reconciliation is for a company, all expenses related to transacting in cryptocurrency are deductible for tax purposes.

For that reason, it's important to analyze if you've included deductible expenses regarding both your business income and investment activities when reconciling crypto transactions.

2. Reconcile Against CEX Accounts

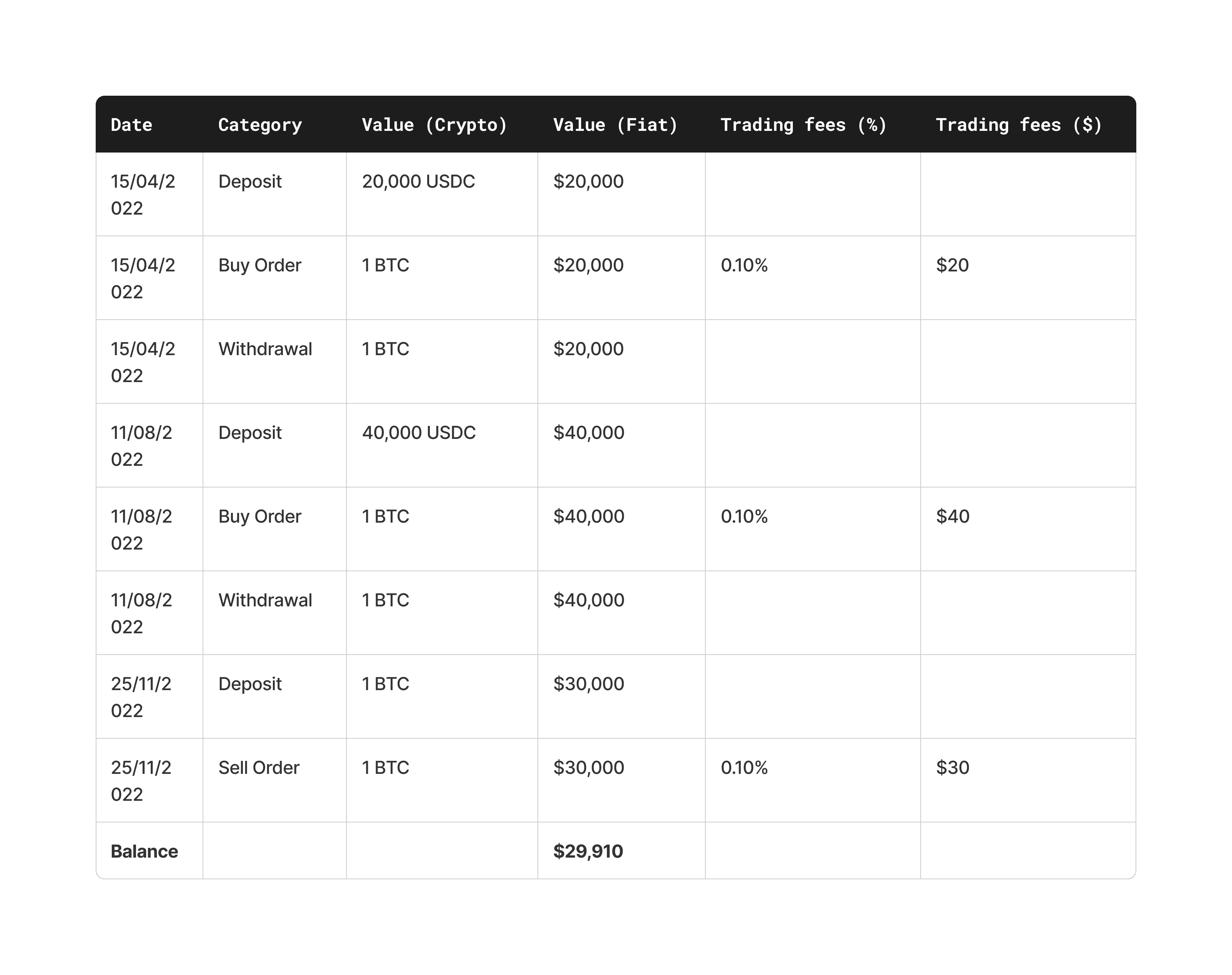

Now, let's explore the records of exchange activity where you purchased and sold BTC to calculate realized and unrealized gains/losses:

Note: Under most accounting standards the FIFO (First In, First Out) method should apply to valuing gain/(loss) on asset sales.

The cost basis of the first BTC you bought is $20,050 ($20,000 + $20 + $30), and it is $40,070 ($40,000 + $40 + $30) for the second.

If you sell the last BTC you purchased with the Last In, First Out (LIFO) cost basis method, your:

Realized loss becomes $10,070 ($30,000 - $40,070)

Unrealized gains equal $10,000 ($30,000 - $20,000)

On the other hand, choosing the First In, Last Out (FIFO) method to sell the first BTC your organization acquired will result in:

$9,950 ($30,000 - $20,050) realized gains

$10,000 ($30,000 - $40,000) unrealized losses

Because most companies are maintaining their crypto records, this is an area of the reconciliation that provides the most challenge. Assets need to be allocated into tax lots to ensure appropriate gains and losses are calculated, unrealized gains/(losses) understood and revaluations provided. This applies to both CEX accounts and self-custody assets.

3. Make Changes When Necessary

After reconciling, both the items and balances in your books should match the ones in your on-chain treasury and CEX accounts.

If that's not the case, then review the process again to make the necessary corrections. It's important to keep the following in mind to avoid errors:

Include only deductible expenses related to your business' income and computed gains/(losses)

Always add dates, crypto and fiat values, fees, and categories for transactions

Use digital asset prices at the time of each transaction to calculate the fiat value of each item in your books

Ensure you are comparing using appropriate data cut off dates; with high velocity of transactions, hourly cut off’s when doing a reconciliation can make a big difference

In the end, the records on your books will match the ones on block explorers and exchange accounts. After that, you’ll be ready to file your corporate tax returns.

In the US, you can report your business income via Form 1120, Form 1120-S, or Form 1065 and capital gains/losses via Form 8949 and Form 1040 Schedule D. UK-based crypto enterprises can declare both their revenue and CGT (the latter is also treated as corporation tax) online or by filling out the CT600 form.

To learn more specifically about non-fungible token taxation, we highly recommend reading our NFT taxes guide.

When to Consider Crypto Tax Reconciliation Support?

Tax reconciliation is a significantly more complex process in crypto than in traditional finance. Besides relying on multiple sources, Web3 organizations must manage these large volumes of data constantly.

While smaller organizations might handle this process on their own, manual reconciliation can quickly become unmanageable at scale. This makes reconciliation tedious and even prone to human error.

Integral removes this complexity with a reconciliation process that moves as quickly as your digital assets. World-class web3 organizations can maintain control at scale and save valuable resources with:

Automated workflows and blazing-fast month-ends

Automatic capital gains/losses calculation

Real-time treasury visibility and management with minute-by-minute pricing

Let Integral simplify your crypto tax reconciliation so you can focus on growing your operations. Book a demo with our team and we’ll show you how quickly it can be done.