A Trust Study: Delphi Ventures Implements Integral for Accounting and Operations

Delphi Ventures transformed their operations, scaled trust, and harnessed the full potential of blockchain through a seamless integration with Integral's cutting-edge accounting and operational solutions.

Challenges

Operating State Before Integral: Manual Processes Create Risk

Many companies, businesses, DAOs, and investment funds that actively decide to interface with digital assets face an operational problem: accounting and operations often take a back seat and are solved for after-the-fact. These crucial business aspects are frequently relegated to manual, labor-intensive processes, leading to an operating state fraught with inefficiencies, risks, and missed opportunities. Delphi Ventures was no exception at its inception in 2019, encountering the following problems in its early days.

Intensely Manual Efforts

At their core, blockchains fundamentally enable transparent accounting through their open and immutable ledgers. Like many operators in the space, Delphi Ventures found themselves trapped managing intensely manual processes. Blockchains, designed for transparency and trust, inherently simplify and automate the accounting process for anyone who embraces their potential.

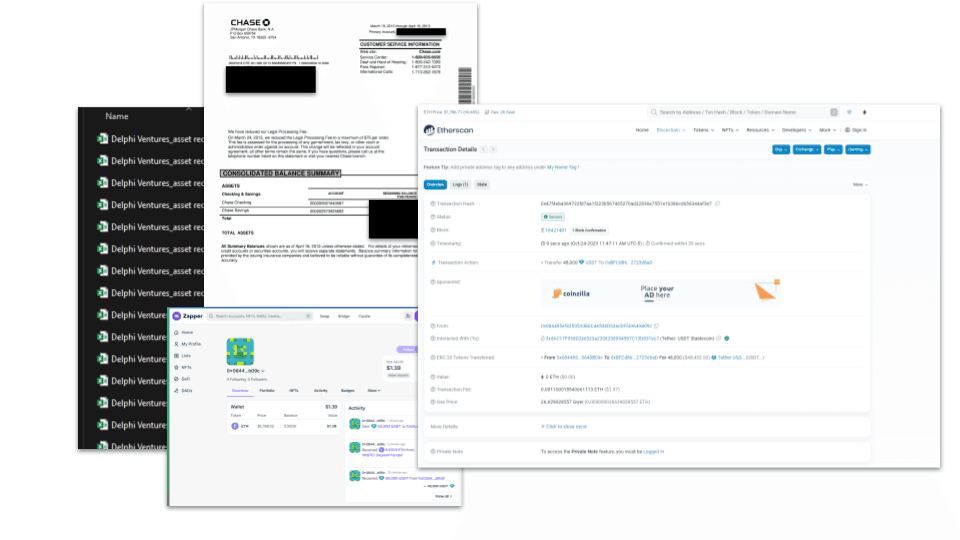

Delphi Ventures - like many funds - struggled with a library of disjointed spreadsheets, manual data entry, and the potential for human errors, hampering their ability to harness the blockchain's inherent advantages. Delphi Ventures relied on heavy human inputs, blockchain explorers, protocol front ends, .csv files, and .xlsx files to reconcile assets.

Representation of Delphi Ventures Operational Stack before Integral

Manual Processes Increase the Risk of Errors, and Decrease Trust

Centralized, manual processes are reliant on human intervention and susceptible to errors. Human involvement in data entry, copy-pasting, and spreadsheet management elevates the risk of inaccuracies, potentially undermining trust in financial data integrity for Delphi Ventures' investors, auditors, employees, and other stakeholders.

Key Man Risk

In their pre-Integral days, Delphi Ventures faced a substantial key man risk. Digital asset accounting and operations were manual in nature and relied heavily on specific individuals within the organization. Operations at the scale of Delphi Ventures result in material unrealized, concentrated key man risks to the Ventures business.

Accounting as a Siloed Cost Center

Traditional accounting functions were viewed as a cost center, draining resources and time without offering strategic value. Delphi Ventures realized the need for a solution that could transform their accounting and operations into a value driver, adding strategic benefits beyond mere bookkeeping.

Solution

Implementing Integral: Trust and Efficiency Outcomes at Venture Scale

Integral's core value is trust and the alignment with Delphi Ventures’ mission was obvious. After learning of Integral’s ability to aggregate, track, and provide real-time insights into web3 assets across various chains, coupled with aligned values regarding the role of accounting in a tokenized world, Delphi Ventures implemented Integral's technology across the entirety of its fund structures.

Delphi Ventures, its service providers, auditors, and investors now enjoy a trusted, legible, reliable, and comprehensive overview of their portfolio and income. This transparency has transformed Delphi Ventures' approach to managing crypto assets, reducing the inherent risks in this asset class.

Asset Support

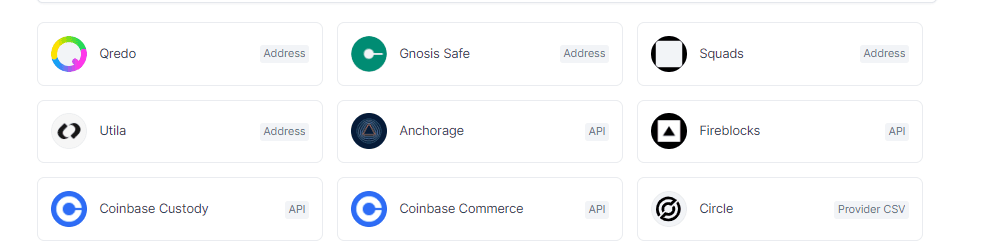

Completeness is a baseline expectation for any asset manager’s accounting and operations suite. Given the breadth of Delphi Ventures’ portfolio, procuring a technology solution that provided completeness was critically important. Delphi Ventures has some unique requirements such as capturing Thorchain’s streaming swaps, transactions across various L1s and L2s, Axie ecosystem activity on the Ronin Chain, tokens on Cosmos, and NFTs on various chains.

A Small Example of Integral Supported Assets

Data Quality

As an asset manager, Delphi Ventures has zero capacity for missing or incorrect values sourced from blockchain data. The Integral team has a rigorous QC process that includes automated data validation, cross-chain reconciliation, anomaly detection, and manual review protocols to ensure accuracy and reliability in all financial records. Integral’s platform has supported Delphi Ventures in passing its funds’ financial statement audits.

Institutional-Grade Feature Set

Delphi Ventures operates multiple funds with accounting and operational complexity including: token unlocks, illiquid non-token based investments, and multiple entities.

Integral's multi-entity feature

Results

Improving Efficiency

The time saved by accounting for blockchain transactions in Integral is measurable. There are two key KPIs that Delphi Ventures measures ROI on the Integral product with:

Time saved in reconciliation: The adoption of Integral has led to a significant reduction in the time spent on reconciliation. What was once a labor-intensive process spread across multiple teams, blockchains, spreadsheets, and data sources has now been streamlined to a fraction of the time it once required. Delphi Ventures now dedicates fewer resources to manual reconciliation, allowing their team to focus on higher-value strategic tasks for their portfolio companies.

Effectiveness as a subledger: Integral plays a pivotal role as a subledger within Delphi Ventures' operations. What sets Integral apart is its capability to provide outputs that non-crypto-native service providers, including tax accountants, bookkeepers, accountants, advisors, and auditors, can seamlessly understand and work with. By presenting clear and easily interpretable financial data, Integral acts as a bridge between the complexities of the crypto world and the more traditional financial domain. This functionality not only saves time for Delphi Ventures but also streamlines the collaborative efforts with their service providers. Now, there's a single, reliable source of truth that fosters efficient and error-free communication.

Scaling Beyond Accounting

Delphi Ventures viewed the implementation of Integral not simply as a crypto subledger upgrade, but instead as a comprehensive solution that scales beyond the traditional accounting department. Integral plans to take a role in tax planning, FP&A, and will encompass execution and actionable intelligence. Other legacy and current technologies that Delphi Ventures evaluated propose to solve one problem: accounting. With Integral, Delphi Ventures is looking forward to using a next-generation operating stack built on crypto rails, rooted in accounting.

RELATED STORIES

The future

Delphi Ventures supports over 100 founding teams in building blockchain technology – a fundamentally new way for human beings to coordinate at scale, removing intermediaries. Delphi Ventures genuinely believes that trusting blockchains goes beyond the chain. Implementing products like Integral are critical to slowly building trust in these technologies over time.

About Integral

Integral’s technology is at-scale institutional accounting and operational technology for asset managers. Learn more about Integral’s fund solutions here.

About Delphi

Delphi Ventures is a venture capital firm driven by a mission to accelerate the decentralized future. Delphi Ventures makes high-conviction investments in decentralized technologies, collaborating with founders to provide expertise in token and governance design, go-to-market strategy, and community building. A commitment to transparency and integrity grounds their business.

Delphi Ventures fundamentally believes that increasing trust in digital asset technologies is critical to the adoption of blockchain technology – and trusts Integral to support that mission internally.

Delphi Ventures has been investing in early-stage crypto founders since 2019. Learn more about their firm at: https://delphiventures.io/