Integral Exceeds $100 Billion Accounted For in Under 1 year

Over 150 enterprises using digital assets rely on Integral’s accounting and treasury management suite, reconciling over $100 billion dollars of value in under 1 year.

Integral Treasury announced that its web3 accounting and treasury management platform has accounted for over $100 billion worth of web3 transactions in the last year. Integral is trusted by over 150 of the largest blockchain organizations globally to fulfill key reporting requirements - tracking treasury positions, aggregating transactions, and performing key tax calculations. Top Gaming organizations, NFT Collections, Market Makers and Fortune 500 brands rely on Integral to integrate their blockchain activity with pre-existing financial processes and software.

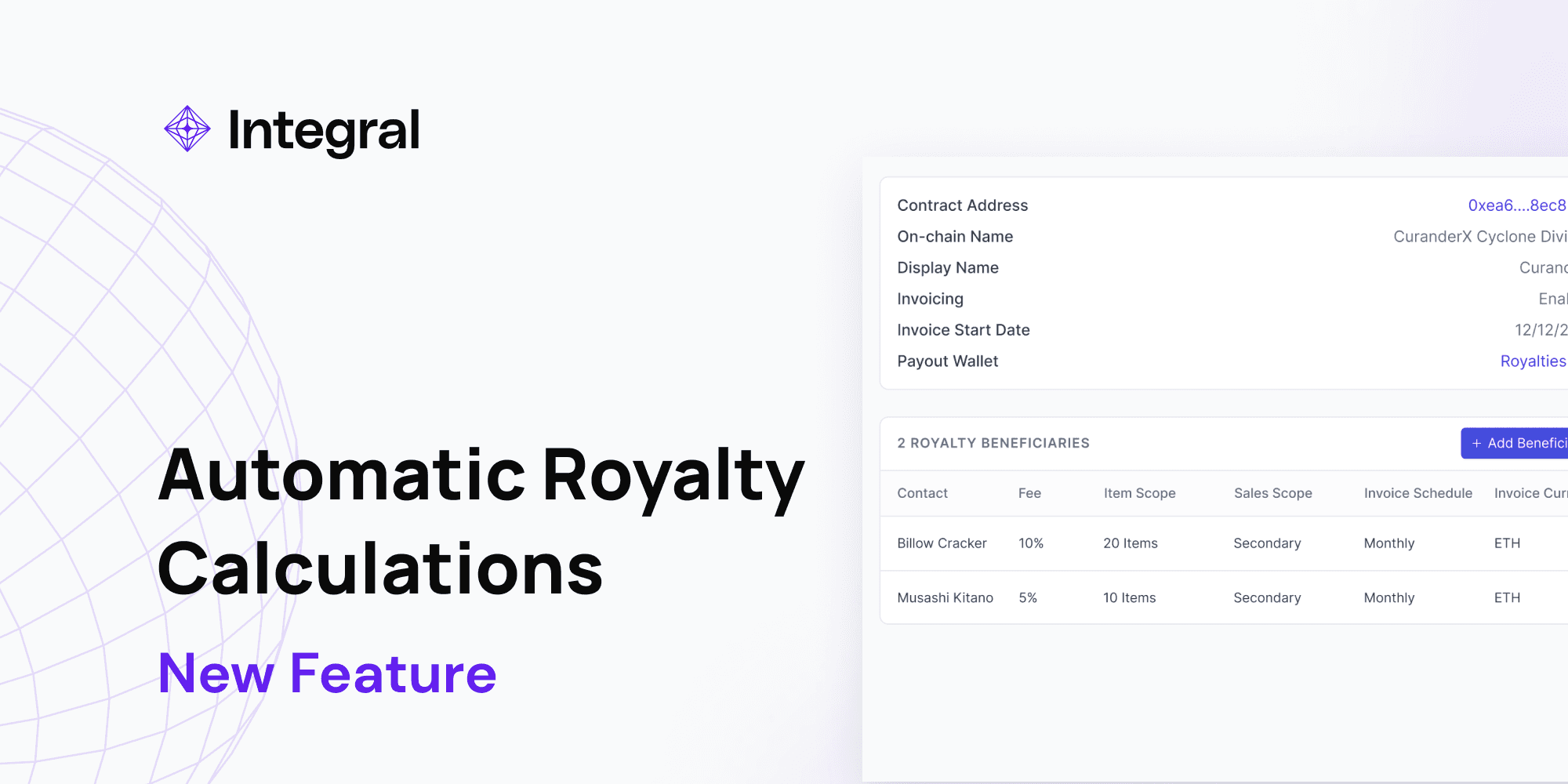

As regulatory pressure and new accounting standards for blockchain assets evolve globally, web3 businesses face growing pressure to establish compliant, transparent financial processes and reporting frameworks. However, these businesses encounter numerous challenges in consolidating financial data, performing essential accounting tasks, and navigating unpredictable market events. This complexity is amplified by high transaction volumes and diverse financial activities inherent to operating a web3 business at scale. Resolving these challenges in web3 financial management is crucial to driving global adoption of blockchain assets and technologies amidst mounting regulatory pressure.

“Integral did a world class job of customer discovery, on-boarding, and engagement. They took the time to understand our financial infrastructure, transactions, and data, and moved quickly to build out custom solutions to aggregate our high volume of complex transactions.”

George Zeng - COO of DyDx

“The Integral team has done a lot in the last year. We’re proud to move past the $100 Billion milestone, but it’s only the beginning. We want to make it easy for enterprises to adopt web3 technologies, without creating extra compliance risk or manual back-office work.”

Gui Laliberte - CEO of Integral

Integral was founded in 2022 by Ex-Sequoia & Electric Capital backed founder Gui Laliberte, & CapIntel Founder Jeremy Tupper. The Integral team consists of veteran founders/technologists hailing from technology leaders that include Palantir, Meta, Amazon, VMWare & Coinbase. Integral’s investors include Electric Capital, Elad Gil, Balaji Srinivasan, Hustle Fund, Maple VC, Mantis, founders/executives of leading web3 companies such as Anchorage, Dapper Labs, dYdX, and many more.

Integral is offering a zero-cost consultation to qualified finance teams looking for an enterprise-ready web3 back office – learn more here.